Introduction:

Over the last 10 years, the automotive industry has witnessed unprecedented levels of disruption, and this trend is expected to persist over the next decade and beyond. The convergence of Autonomy, Connectivity, and Electrification (ACE) technologies is ushering in a new era of mobility with a promising future. However, the introduction of incremental changes and additional features in vehicles during this period has significantly increased vehicle complexity. As a result, time-to-market pressures, development challenges, and maintenance costs have skyrocketed, making it almost unbearable for many vehicle manufacturers.

These challenges, coupled with new technologies and shifting market dynamics, are driving fundamental changes in how the automotive industry approaches designing, manufacturing, and delivering new mobility solutions. This has resulted in a high level of innovation, offering new revenue streams and profit-pool opportunities to a larger and more complex automotive supply chain that is searching for a new equilibrium.

The Software Defined Vehicle:

To speed up innovation in the automotive industry, OEMs are developing new electrical and electronic systems that can cater to both current and future requirements. Based on a 2021 Wards survey – “Automotive Software and Hardware Architecture Revolution” – OEMs identify their making next-generation vehicles flexible and future proof as their top system challenge as (see Figure 1 below). Future-proof architectures would allow vehicle manufacturers to continuously update their vehicles throughout lifecycles and maintain a relevant user-experience that keeps pace with fast evolving markets such as IT and consumer electronics.

Closely following that, the respondents along the supply chain recognize the importance and role of a modern software architecture, improved security and in-vehicle networks that are up to the task. Hardware components and performance are considered less critical – likely because system integrators and OEMs are confident in the steady advancement and integration that is taking place in the semiconductor industry.

On the hardware side, centralized and modular ECU hardware is already the state of the art, enabled by higher-performance and highly integrated semiconductor components. These high-powered computers, as well as data-rich sensors, require high-speed, low-latency network connectivity – a role increasingly fulfilled by automotive Ethernet, given its speed, security, flexibility, and cost-effectiveness.

More significantly, the focus and centre of gravity of in-vehicle electronics system is quickly moving from hardware-centric to software-centric designs. Software platforms and modules are becoming increasingly prominent as vehicle features are implemented primarily in hardware-agnostic software — leading many to describe these cars as “software-defined vehicles.” In these future-proof architectures, functions and features will be upgraded via software updates applied to still essential, often “over provisioned,” underlying hardware platforms.

In this software architectural revolution, technologies from the IT industry, such as microservices, SOA (Service-oriented Architecture) and virtualization will enable an efficient and cost-effective foundation to future-proof fleets and shorten time-to-market, as well as reduce development costs.

Software flexibility, especially over-the-air “updatability,” will help maintain a vehicle’s relevance during its entire lifecycle (still 7+ years), avoiding obsolescence and better aligning with consumers’ digital and connected lives. And hardware-agnostic software will enable the separation of hardware- and software-development cycles – helping auto- companies accelerate software development and enhance in-vehicle features and functions independently of hardware cycles.

This massive transformation will profoundly impact operating processes along the entire supply chain – requiring vehicle manufacturers to transform their R&D and manufacturing organizations, as well as their business focuses. This is where new industry players, with expertise in software and data management, can engage in tight collaboration and partnerships with manufacturers and Tier 1s to close the technology gap for legacy players.

The SDV Journey:

Wards Intelligence believes the industry is only in the initial stage of the SDV journey. Software-defined vehicles are expected to disrupt and significantly impact operations for OEMs, traditional suppliers and technology companies that are investing in automotive. Vehicles are the last link of the chain in a much wider eco-system that encompasses the OEM´s back-end operations and manufacturing facilities, as well as infrastructure that includes the “Cloud.” In the past, these domains were largely separate; but they are becoming much more interdependent in the new world of mobility.

Connectivity is the underpinning technology enabling this revolution — bridging and synergizing previously disconnected worlds. Connectivity enables the creation, development, and control of a new creature: the software-defined vehicle.

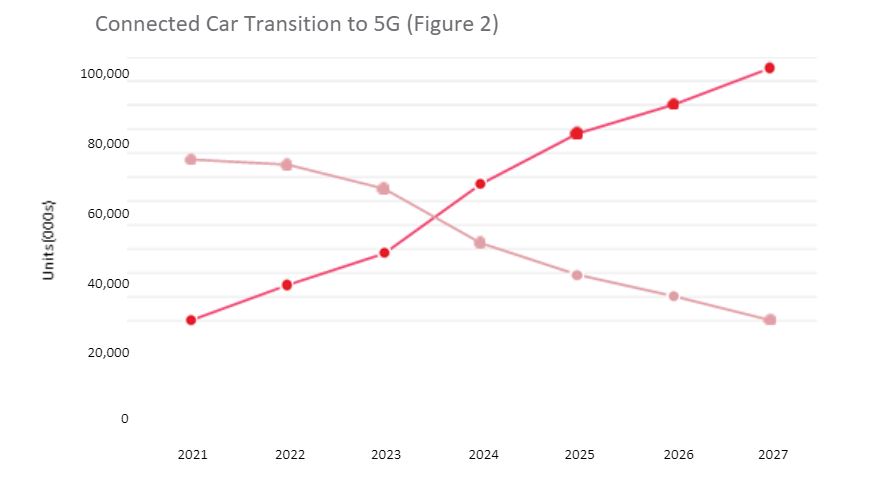

4G cellular networks enabled the Connected Car, with data-centric services such as General Motors’ OnStar, content-services like Pandora and the beginning of OTA updates. 5G technology – which is expected to replace 4G over the next five years (see chart below) – will turbocharge connected services. Notably, 5G’s greater bandwidth, higher speeds, and lower latency will support: a) extensive in-vehicle software updates, b) terabytes of data to be shared and monetized and c) real-time V2X services, mainly driven by safety functions.

The bidirectional flow of data to and from the car over these connections is the game changer that will open a vast range of market opportunities. Centralized data collection and management will be essential for the new mobility ecosystem, with the flexibility to decide exactly what data to collect and when – whether periodically, streamed in real-time, event-triggered or on-demand. Applications and services that leverage data created inside and outside the vehicle, combined with the ability to change or enhance vehicle capabilities dynamically, will enable use cases not previously possible, such as:

These capabilities will foster new use cases and business models that add higher value to the market and slowly replace traditional sources of profit associated with vehicle sales. The figure below from a 2021 Wards survey on “Future Software Defined Vehicle” identifies the top services and monetization opportunities that OEMs and Tiers expect to generate significant revenue streams enabled by the new connected and software defined mobility approach. These and other new business models and revenue streams are expected to expand the profit pools, distributing it along the life of the vehicle, while, paradoxically, enabling vehicles to be sold at closer to cost.

Beyond OTA:

Over-the-air updatability is a key capability of the SDV. The ability to remotely fix issues, enhance performance, and add new capabilities after production will significantly impact customer experiences and automakers’ profits. For example, Tesla frequently deploys software updates — ranging from performance tweaks (e.g., braking, power management) to software fixes and the addition of major new functionality — to reduce costs and delight customers. Other OEMs are now delivering more OTA capabilities in their new vehicle platforms, such as Ford with the Mustang Mach-E and F-150.

However, continuously developing and deploying new software has significant implications, such as:

As a result, innovative approaches are reaching the market that offer flexible dynamic configurability as well as automation capabilities that can reduce investment in software, infrastructure, and in-vehicle electronics. Vehicle software that is dynamically configurable and controllable enables OEMs to enhance vehicle performance and add unctionality without having to develop and deploy new software. It also provides a foundation for mass- personalization without burdening core software with unnecessary complexity.

These new approaches can be integrated into existing hardware, thus enhancing vehicle relevance and the user experience without big changes in the vehicle architecture that would obsolete legacy fleets. For greater flexibility, automakers can build in additional capacity with their hardware and software components to provide room for future improvement. Doing this would minimize the need to update and requalify entire modules (SW and HW) to add features or functions.

Conclusion:

In conclusion, the software-defined vehicle (SDV) revolution has only just begun. In SDVs, software will not only define vehicle functions, features, and mobility applications but also create platforms and core components that will enable continuous value addition. Software and data will enable the expansion of the automotive ecosystem beyond the vehicle itself, paving the way for new business models and profit-pools in adjacent industry domains.

OEMs are presently developing portable and updatable vehicle software that will facilitate hardware flexibility, ECU consolidation, and remote updates to fix defects and add features post-start of production. A new set of complementary technologies and solutions is emerging that leverages dynamic configurability and controllability to optimize vehicle performance, add new functionality, and personalize the user experience without requiring new software. These new capabilities complement software OTA and enable new use cases while cost-effectively keeping vehicles healthy, current, and secure.

As OEMs continue on the SDV path, they should focus their internal software development on areas of differentiation and seek out expert partners to provide complementary innovative software to help them build world-class mobility solutions.